florida estate tax exemption 2021

Ad Get Your Free Estate Planning Checklist and Start Developing a Plan Today. For 2022 the personal federal estate tax exemption amount is 1206 million.

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Florida Estate Tax.

. Given that Florida has around a 2 average tax rate that means a homeowner with 500000 in portability will see a tax bill about 10000 a year lower than it would be without it. Previously federal law allowed a credit for state death taxes on the federal. Florida estate tax exemption 2021.

The District of Columbia moved in the opposite direction lowering its estate tax exemption from 58 million to 4 million in 2021 but simultaneously dropping its bottom rate. The includible property may consist of cash and securities real estate insurance trusts annuities business interests and other assets. Assessed Value 85000 The first.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Ad Valorem Tax Exemption and Return for Educational Property. A federal change eliminated Floridas estate tax after December 31 2004.

This means that when someone dies and the. The homestead exemption and Save Our Homes assessment. November 28 2021 alison brie dave franco.

Once you have accounted for the Gross Estate. Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability. Instead individuals and families pay a federal estate tax on transferring property upon death when an estate exceeds a specific threshold also known as the estate tax base.

Buyers if you bought your home in 2021 have you filed for Homestead Exemption yet. You might still owe the federal estate tax which kicks in at 117 million for 2021. The good news is Florida does not have a.

Get the Info You Need to Learn How to Create a Trust Fund. DOC 55KB PDF 67KB DR-504ED. Floridas Homestead Tax Exemptions for each year must be filed by March 1.

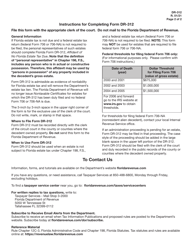

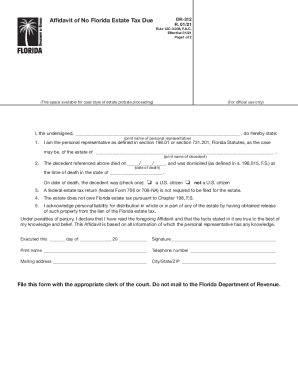

Ad Download Or Email Form DR-312 More Fillable Forms Try for Free Now. There are a few states that levy taxes on the estate of the deceased generally referred to as the inheritance tax or the death tax. To be eligible for the exemption Florida law requires that political subdivisions obtain a sales tax Consumers Certificate of Exemption Form DR-14 from the Florida Department of Revenue.

The exempt increased from 117 million for 2021. What this means is that estates worth less than 117 million wont pay any federal estate. Ios icon pack free download mesh wire fence for horses.

Ad Valorem Tax Exemption Application Charter School Facilities. The Florida homestead tax exemptions and benefits derive from Article VII Sections 4d and 6 of the Florida Constitution and are codified in Chapter 196 and Section 193155 Florida Statutes. 13 hp briggs and stratton engine.

The first 25000 of value is exempt from all property tax the next 25000 of value is taxable and the remaining 15000 of value is exempt from non- taxes.

Desantis Delivers An Estate Tax Savings Gift For Floridians

Estate Tax Exemption 2021 Amount Goes Up Union Bank

Tax Flyers Tax Services Tax Refund Tax Prep

How Your Estate Is Taxed Or Not

Florida Gift Tax All You Need To Know Smartasset

Florida Estate Planning Complete Overview Alper Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Florida Estate Planning Guide Everything You Need To Know

Florida Estate Tax Rules On Estate Inheritance Taxes

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

Dr 312 Fill Out And Sign Printable Pdf Template Signnow

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

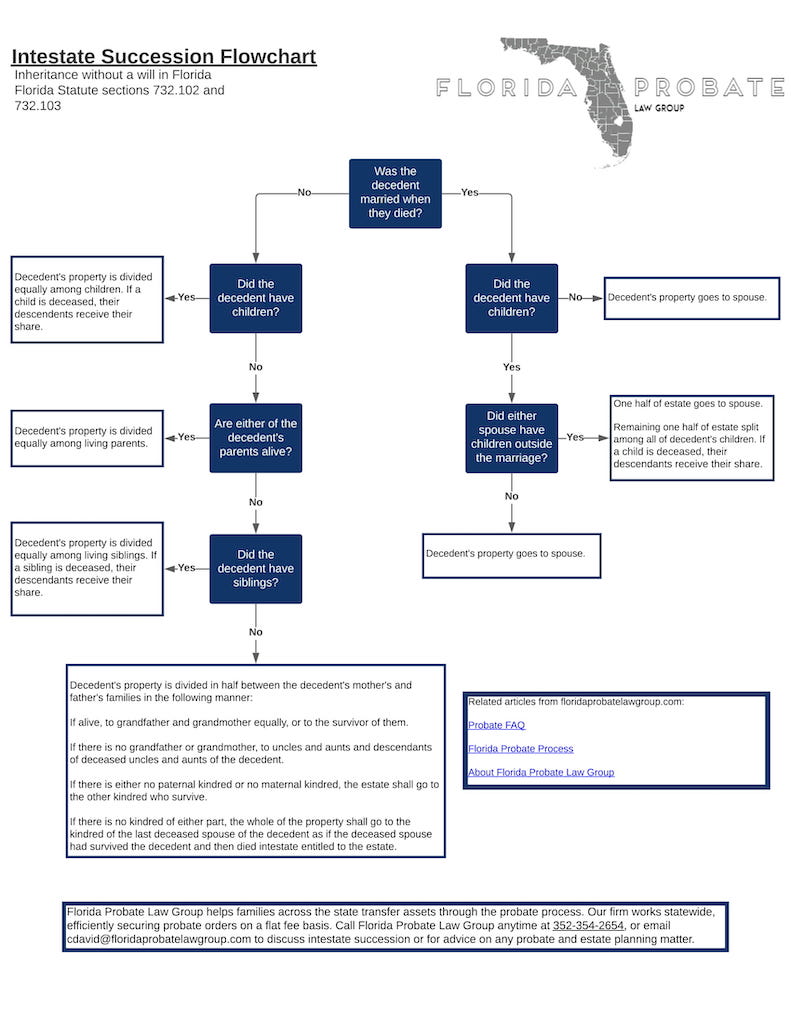

The Complete Guide To Florida Probate 2022 Florida Probate Blog January 2 2022

Florida Attorney For Federal Estate Taxes Karp Law Firm

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Estate Tax Planning In Florida And Portability Estate Planning Attorney Gibbs Law Fort Myers Fl